The first round of funding, which was completely unexpected to many, occurred in early April of 2020, when $30 billion was deposited directly into the accounts of eligible practices. Throughout 2020, additional funds were later rolled out in phase 2 and 3, as well as through targeted distributions to specific industries, such as rural providers and skilled nursing facilities. Of importance is that for all practices receiving these funds, there are several rules to be followed.

While the COVID-19 relief provisions, as part of the CARES Act, provided a lifeline for many medical, dental, and other healthcare-related practices during the pandemic, that support was not without certain compliance requirements and reporting, which we will dive into within this article.

Attestations

First, within 90 days of receipt of the funds, each provider was required to attest to certain terms of use. For those electing to return the funds, it was required to be done within 14 days of this attestation. Attestations were required for receipt of funds in all phases and were to be completed through use of a portal with the HHS. This portal can be located at:

https://www.hhs.gov/coronavirus/cares-act-provider-relief-fund/for-providers/index.html#how-to-attest

Reporting

As part of the attestation process, any provider receiving more than $10,000 in payments through the PRF would be required to report on use of the funds. While the specifics on the exact reporting took months to be finalized and continued to be reworked by the HHS, the general guidelines were known. Barring no future changes, PRF dollars are to be applied in the order of:

- Certain qualifying expenses that can be directly attributable to coronavirus, and

- Lost revenues.

Of greatest importance is the understanding that the use of these funds must be kept separate and distinct from the use of other coronavirus relief aid. For example, if you report on the use of a personnel or payroll related expense, it cannot also be tied to dollars used in applying for PPP loan forgiveness. Essentially, a practice cannot ‘double dip’.

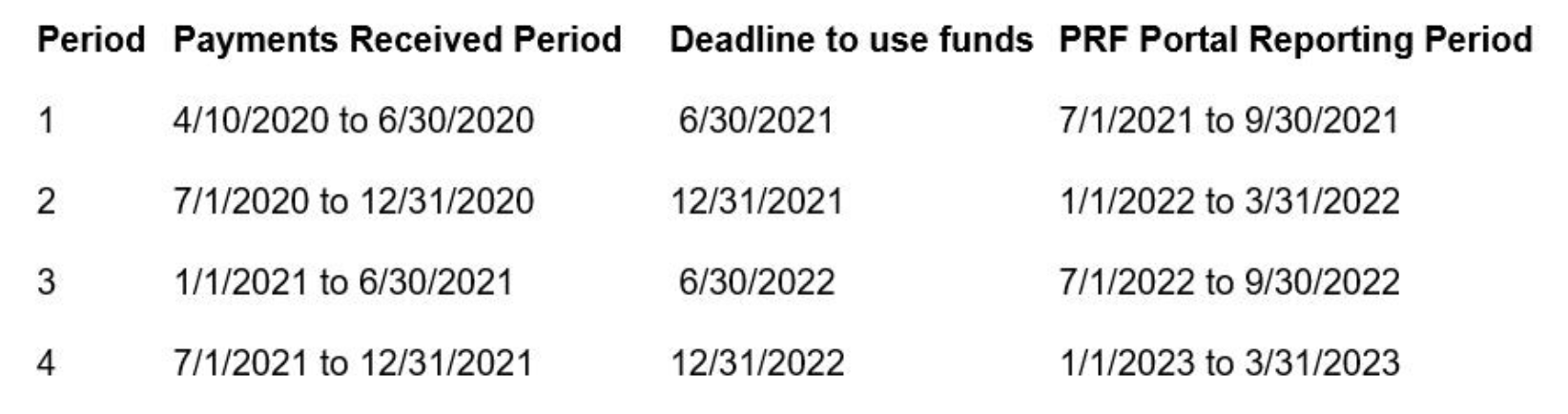

Initially, reporting was set to begin back in the summer of 2020, which was then pushed to the fall of 2020 and then again to January 15th, 2021. However, because of updated legislation and a change in administration, reporting had been delayed even further. In late June of 2021, the reporting requirements were finalized and the reporting portal is now open to many, depending on when funds were received.

For all recipients of the fund, it is important to continue to monitor this process so that a reporting deadline is not missed. To stay on top of this process, the HHS has been updating their site with current regulations at the following link: https://www.hhs.gov/coronavirus/cares-act-provider-relief-fund/reporting-auditing/index.html.

Audit Requirement

One stipulation, not known to many, is that a government single audit is required if the combined federal funds (PRF and other federal assistance) received were more than $750k. Please note, PPP funding does not count towards this total.

A Single Audit would be required of an organization that has $750,000 or more in federal awards. While typically federal funding is awarded to not-for-profits and governmental organizations, the HHS PRF has opened many organizations, including for-profit medical practices, to these compliance requirements. If a practice has received combined federal awards though the Provider Relief Fund in excess of $750,000, a Single Audit will be required.

While the majority of relief programs under the CARES Act (such as the Paycheck Protection Program) are subject to reporting requirements, the PRF has its own distinct rules to navigate. If your healthcare practice took advantage of the PRF in any amount, it is highly encouraged that you speak with an advisor as soon as possible to fully understand the compliance requirements. Navigating federal compliance can be intimidating and confusing, especially if this is your first time doing so. Speaking with an advisor can demystify this process and help ensure that you understand the regulations.