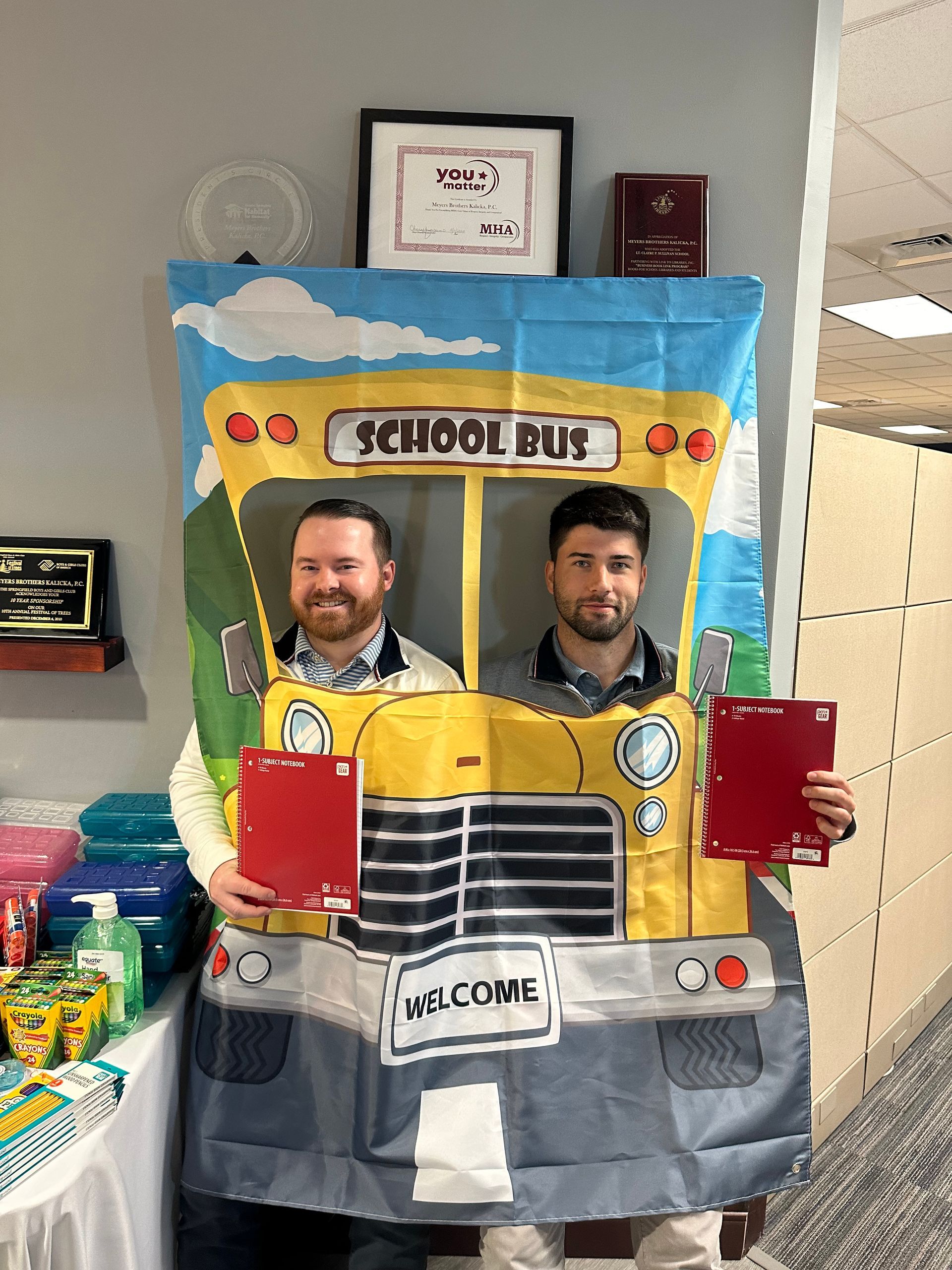

Stuffing the Bus with United Way of Pioneer Valley and team MBK

Summer is nearly wrapping up as August winds down which means students are gearing up for the new school year! Meyers Brothers Kalicka, P.C. (MBK) partnered with United Way of Pioneer Valley’s annual campaign Stuff the Bus to collect school supplies for the surrounding local elementary students. United Way of Pioneer Valley has established community roots for over a 100 years. The organization is focused on providing essential resources, inclusiveness, and developing further connections within the community.

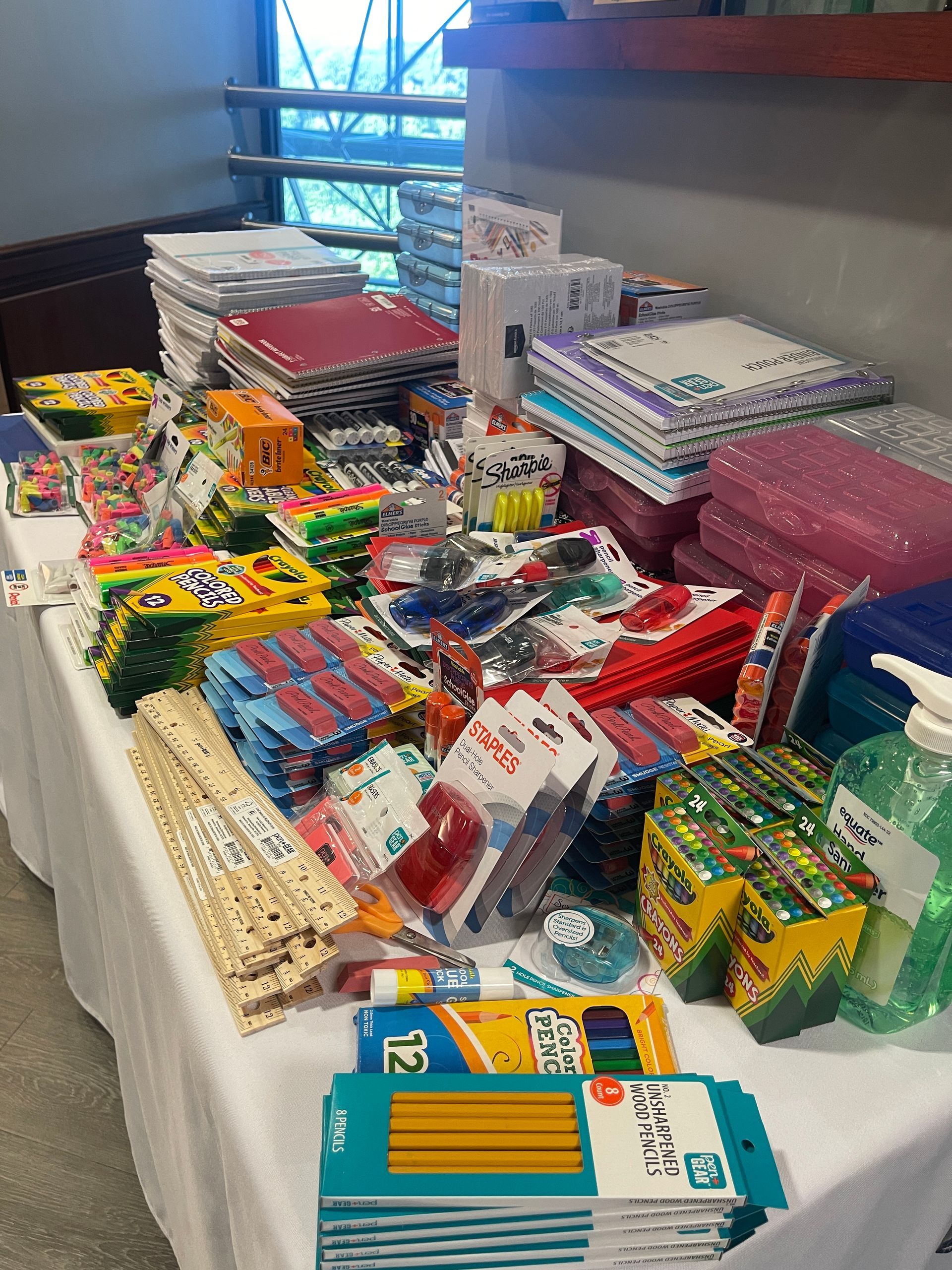

Participating for a third year, team MBK collected unopened school supplies led by champions Partner, Matt Nash and Senior Associate, Chris Soderberg. United Way of Pioneer Valley set a donation goal of stuffing 700 backpacks for elementary students. This year the firm expanded the drive to include donations for teachers’ classroom supplies. MBK donated a surplus of items to United Way of Pioneer Valley. Donations included: backpacks, notebooks, crayons, glue sticks, pencils, pens, erasers, pencil sharpeners, rulers, pencil boxes and cases, loose leaf paper, composition books, highlighters, index cards and post-it-notes. Donations were dropped off to the United Way of Pioneer Valley last Monday and will later be distributed to Hampden County, South Hadley, and Granby schools.

To learn more about United Way of Pioneer Valley Stuff the Bus, visit their website: https://www.uwpv.org/stuff-the-bus

This material is generic in nature. Before relying on the material in any important matter, users should note date of publication and carefully evaluate its accuracy, currency, completeness, and relevance for their purposes, and should obtain any appropriate professional advice relevant to their particular circumstances.

Share Post: