One Big Beautiful Bill Act

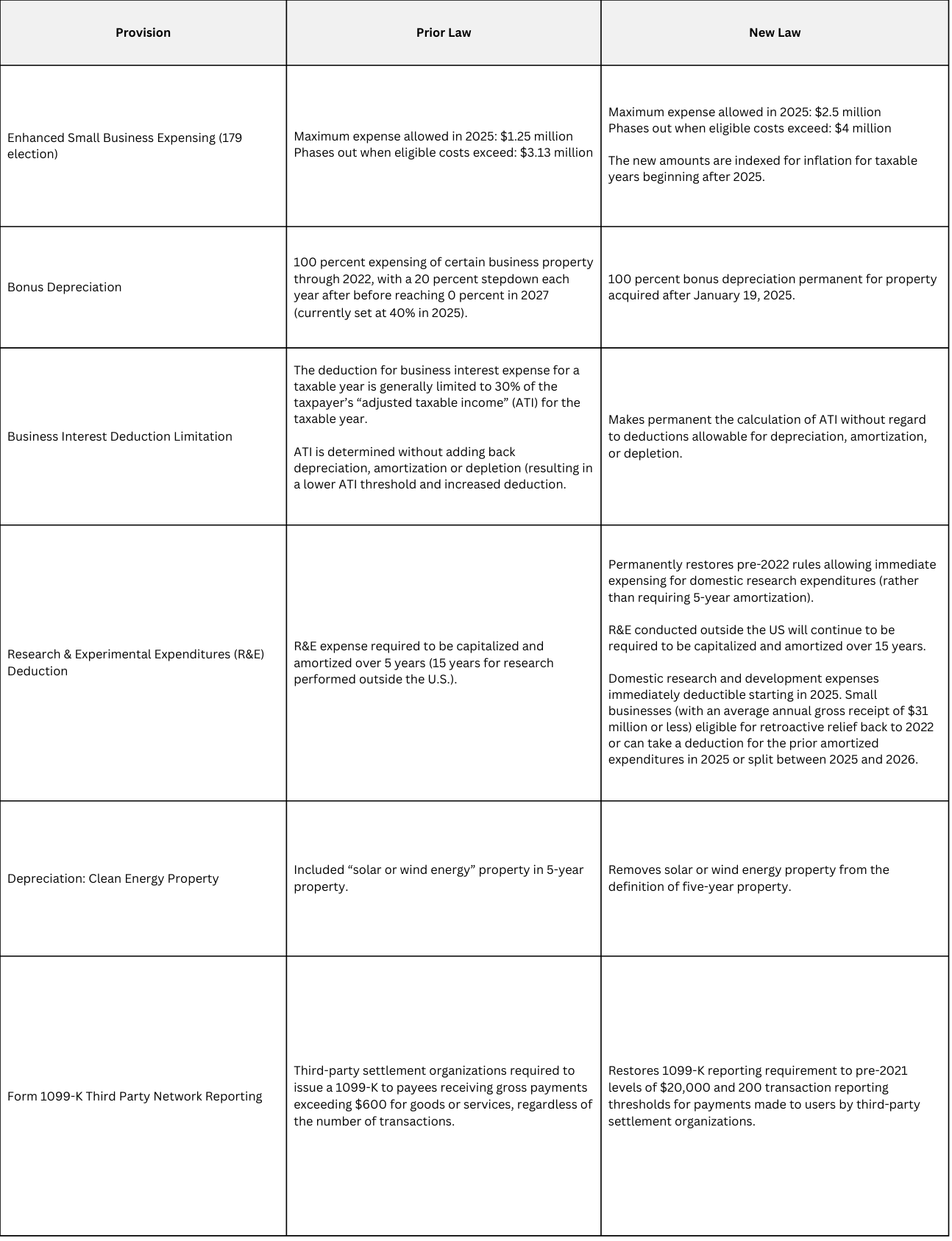

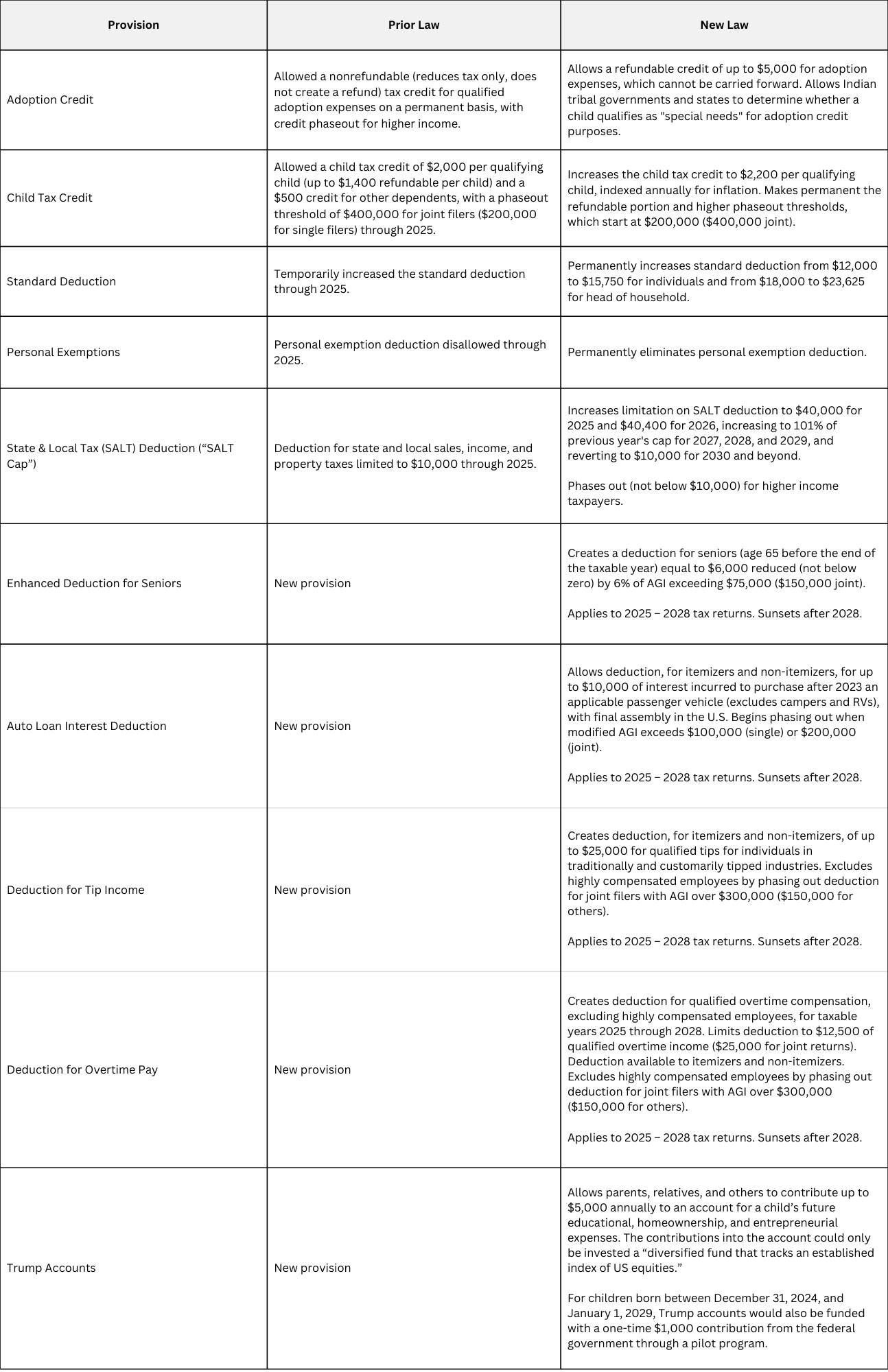

On July 4, 2025, President Trump signed Pub. L. No. 119-21 into law, known as the “The One Big Beautiful Bill Act” (OBBBA). The OBBBA makes permanent both individual and business provisions contained in the Tax Cuts and Jobs Act (TCJA) and also provides new temporary tax provisions, such as new deductions for tipped wages, overtime pay, and auto loan interest.

The OBBBA contains more than 110 tax provisions. Most are effective beginning in 2026. However, a number of important provisions are effective in 2025, including:

Business provisions effective in 2025:

Individual provisions effective in 2025:

Additionally, the OBBBA contains directions to terminate the IRS Direct File program; however, it does not actually terminate the program. It is likely that the program will be terminated before the 2025 filing season.

Additional Individual Provisions to Keep an Eye on for 2026

- Tax credit contributions to scholarship-granting organizations.

- Expansion of 529 programs to include elementary, secondary, and home schooling expenses.

- Charitable Contributions: Nonitemizers may deduct up to $1,000 (single) and $2,000 (joint)

Next Steps:

The new legislation raises both opportunities and challenges. We recommend taking the following actions as soon as possible:

- Evaluate 2025 midyear tax strategies to take advantage of new deductions, credits, and planning opportunities.

- Meet with your accountant to review the new laws and how it may affect your situation and to develop a strategy.

This material is generic in nature. Before relying on the material in any important matter, users should note date of publication and carefully evaluate its accuracy, currency, completeness, and relevance for their purposes, and should obtain any appropriate professional advice relevant to their particular circumstances.

Share Post: