by Lauren Foley, MSA

As 12/31 approaches, an important consideration for employers is proper payroll reporting. W-2s must be sent to employees by 1/31, resulting in a very short window in which to ensure that final payroll is correct for tax reporting. In addition to compensation, employers must be sure that benefits are properly reported, including “fringe benefits.”

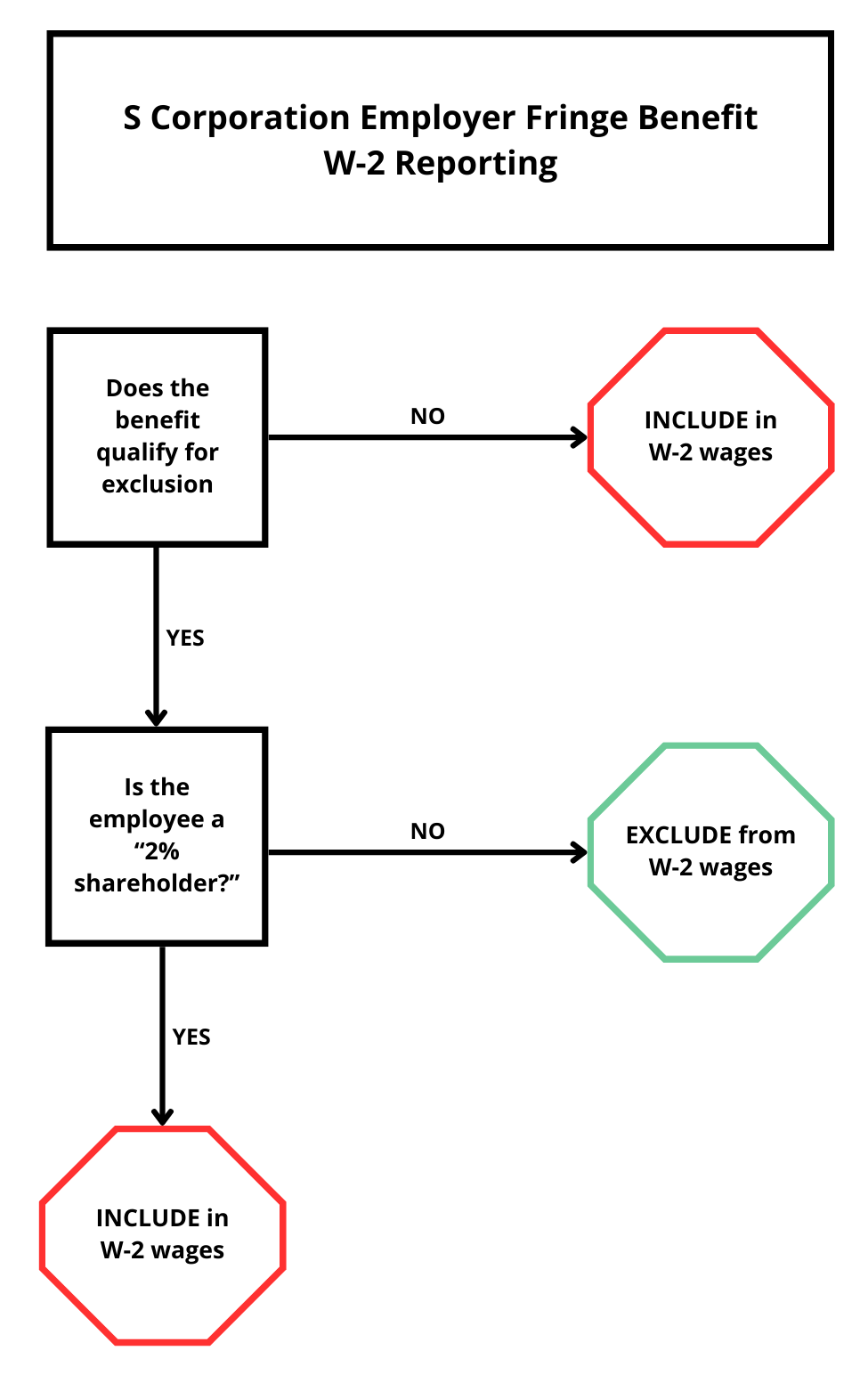

Fringe benefits are considered compensation and included in employee wages, UNLESS they qualify for exclusion (i.e., are nontaxable and omitted from employee wages). However, if the recipient is a “2% shareholder” (i.e., an owner AND employee) of an S Corporation, fringe benefits that otherwise qualify for exclusion are included in wages. The general rules are illustrated as show in graphic below.