Upcoming Tax Event in Partnership with Mental Health Association

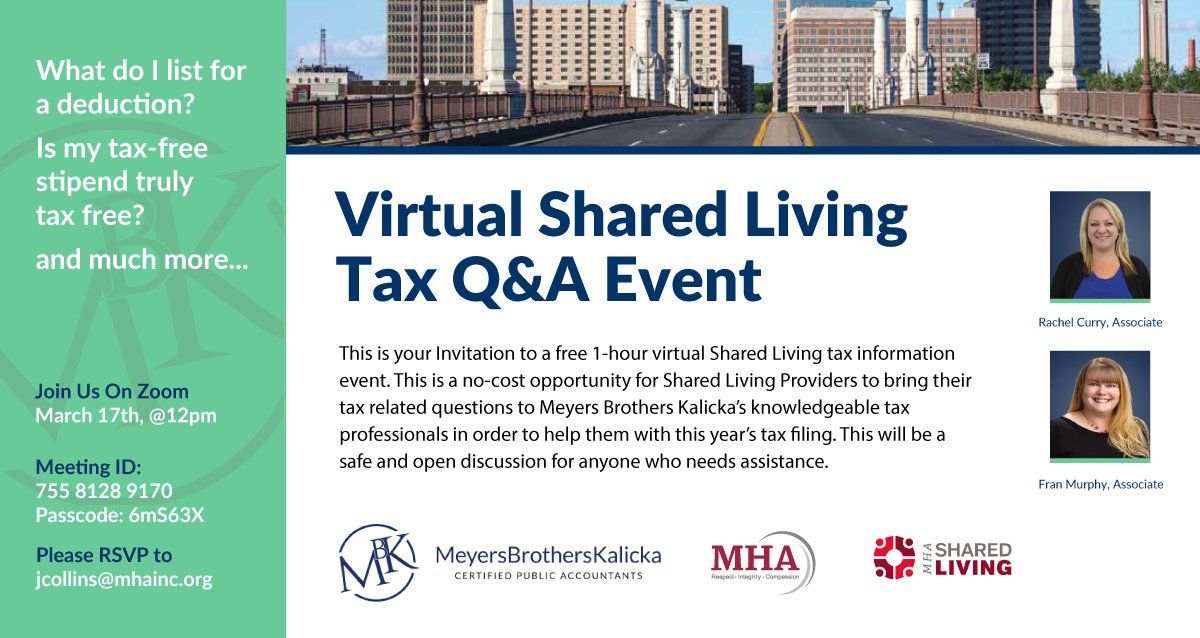

If you are a Shared Living provider or are considering becoming one, get your tax-related questions ready and join us next week on Zoom! Meyers Brothers Kalicka, P.C. will be hosting a virtual event in partnership with MHA (Mental Health Association) on Thursday March 17, 2022 at 12:00 p.m. to 1:00 p.m.

Please RSVP to jcollins@mhainc.org if you plan to join.

Zoom information:

Meeting ID on Zoom: 755 8128 9170

Passcode: 6mS63X

This is a free, hour-long event with tax associates Fran Murphy and Rachel Curry. Fran and Rachel have both been with MBK for ten years and bring a wealth of knowledge to our clients in not-for-profit, individual, and closely-held business tax preparation. This event will allow participants the opportunity to learn about what services the state compensates Shared Living providers for and whether and how this information should be listed on a tax return.

Shared Living program

MHA’s Shared Living program places for individuals served by the Massachusetts Department of Developmental Services with families willing to welcome them into their home with the help of a tax-free stipend between $30,000 to $45,000 paid annually by the state. This program provides an alternative to group home living for individuals under the care of the department. Designated care providers support an individual they are matched with in their daily living including cooking meals, ensuring the individual is taking any medications, providing transport to appointments, and helping the individual work toward specific goals. MHA is currently seeking providers.

About MHA

MHA (Mental Health Association) helps people live their best life. We provide access to therapies for emotional health and wellness; services for substance use recovery, developmental disabilities and acquired brain injury; services for housing and residential programming, and more. With respect, integrity and compassion, MHA provides each individual served with person-driven programming to foster independence, community engagement, wellness and recovery.

This material is generic in nature. Before relying on the material in any important matter, users should note date of publication and carefully evaluate its accuracy, currency, completeness, and relevance for their purposes, and should obtain any appropriate professional advice relevant to their particular circumstances.

Share Post: